Making opportunity zones work for black communities

By Venroy July

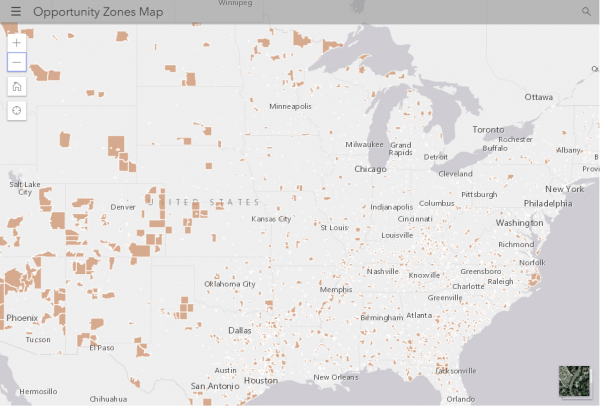

The IRS and the Treasury Department recently released a second set of proposed regulations on the federal Opportunity Zone program, which was created by the 2017 tax law to spur investment in economically distressed census tracts.

The Opportunity Zone law provides significant long-term tax benefits for investors who put capital gains into Qualified Opportunity Funds, investment vehicles set up to deploy funds into eligible property and businesses in designated Opportunity Zones.

The Opportunity Zone law provides significant long-term tax benefits for investors who put capital gains into Qualified Opportunity Funds, investment vehicles set up to deploy funds into eligible property and businesses in designated Opportunity Zones.

Most Opportunity Zones are in majority black and brown neighborhoods, giving rise to concerns about risks of gentrification and displacement of low-income families from their neighborhoods if the program does not adequately protect the interests of existing residents. Some worry that struggling communities will continue to be left behind, while outside investors enjoy the rewards of Opportunity Zone tax preferences.

As this debate plays out, those concerned about ensuring the democratization of the benefits to be provided by the law should be strategic about making the most of the potential benefits, rather than simply throwing up our hands in despair. Through creativity and collective action, black and brown investors and social entrepreneurs can make use of the most favorable aspects of the Opportunity Zone legislation to launch innovative investing initiatives aimed at building wealth in our communities.

LONG TIMELINES FOR ACQUIRING CAPITAL GAINS

At face value, possessing capital gains is the minimum requirement to take advantage of the tax incentives in the Opportunity Zones program. This ultimately creates an effective barrier to entry for many black and brown people. Capital gains are generated by sales of stock, other equity interests or assets, or real estate (generally investment properties, since the first $250,000 of proceeds from sale of a primary residence is not recognized as capital gains).

However, the long timelines built into the legislation provide an opening for participation down the road, even for those not currently sitting on unrealized capital gains. Investments made within a 10-year period of the Opportunity Zone’s designation can potentially reap tax benefits until 2047, provided the regulatory requirements are met. This offers a substantial time period for generating capital gains over the short or long term for later Opportunity Zone investment.

COLLECTIVE ACTION TO BUILD WEALTH

COLLECTIVE ACTION TO BUILD WEALTH

So much of the black experience in America has been about the organizations that connect our community, such as churches, black fraternities and sororities , and service clubs. These groups have played crucial roles in various social movements throughout our history.

The Opportunity Zone legislation offers a unique opportunity for these organizations to make strategic investments aimed at both financial return and social impact. The law in its design incentivizes pooling of resources: for an Opportunity Zone investment to receive tax benefits, it must be made through an Opportunity Fund, which is defined as a corporation or a partnership. (Limited liability corporations taxed as partnerships also qualify.)

Collective action to address systemic barriers to advancement is often discussed within these communities. With Opportunity Zones, incentives for collective action are actually built into and align with the legislation.

CYCLING THE DOLLAR

Along with collective investing, the Opportunity Zone program allows for cycling of investment dollars — the second set of regulations served to confirm this.

Imagine a scenario where an organization pools resources, in compliance with required securities laws, acquires properties and renovates them for sale to members of the community. Each home sale would help the homebuyer begin to accumulate assets that might even be passed on to the next generation.

At the same time, assuming a profitable transaction, the group selling the home could generate capital gains that could then be reinvested in an Opportunity Fund, which would then be utilized for additional investments not only in additional housing but also potentially into businesses of the neighborhood residents or other businesses interested in the reaping the benefits of being located in an Opportunity Zone. We have already done all the work for you and collected all the free spins on registration in a convenient form on our website. In keeping with the regulation, investments would need to be held for the required time periods to reap the full tax benefits of the law, but this strategy could be utilized to truly be transformative for these communities and the people who live there.

Cycling investment funds in this way has the potential to increase returns on various fronts: making money for the investment collective, expanding homeownership in low-income communities, strengthening neighborhood stability, and promoting intergenerational wealth transfer that can help to close the wealth gap.

Although the Opportunity Zones program will almost certainly lead to gentrification as property values increase in areas targeted for investment, it can also offer new paths to black economic empowerment. With innovative approaches, a solid understanding of the risks and rewards of Opportunity Zone investing, and careful attention to regulatory requirements for maximizing tax benefits, we can leverage the Opportunity Zone program to build wealth for black families and revitalize our communities.

Credits: Venroy July \ Black Enterprise

The post Making opportunity zones work for black communities appeared first on National Association of Real Estate Brokers.