In Letter to Congress: Black Wealth 2020 Sends Plea for Unity in Pandemic Relief

(TriceEdneyWire.com) – As the U. S. House of Representatives awaits the political fate of another multi-trillion dollar coronavirus relief bill, called the “Heroes Act”, Black Wealth 2020 (BW2020), a national catalyst for economic justice for African-Americans, is pressing Congressional leaders to unify for equity for the millions of pandemic victims who have yet to receive it.

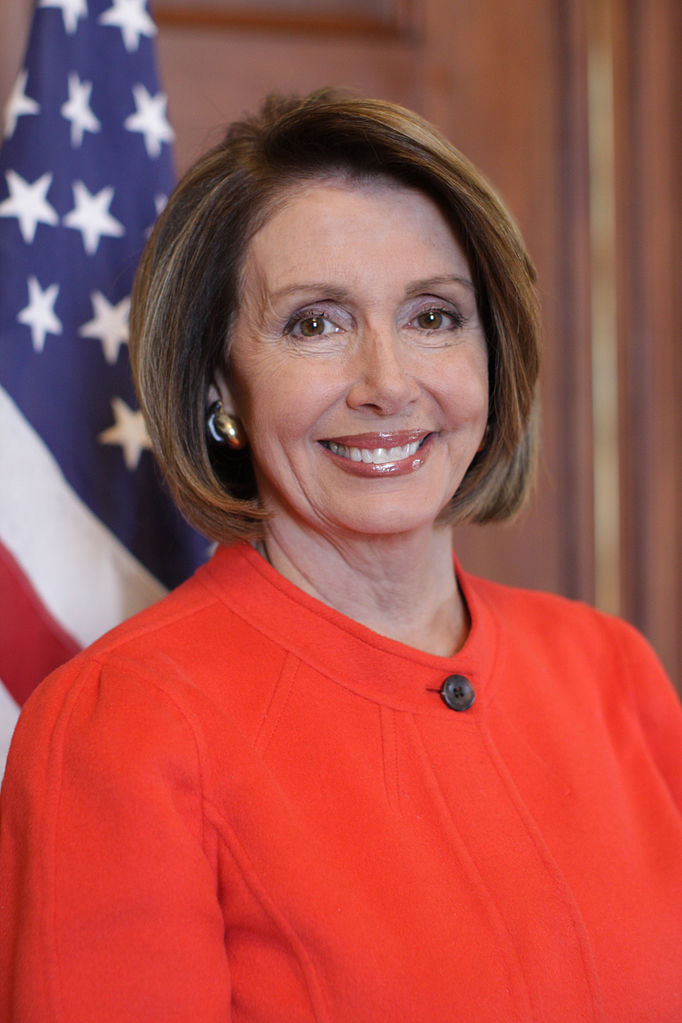

“Each of our respective national organizations is comprised of memberships who are struggling to adjust to the realities of the COVID-19 pandemic. Though the members of this coalition have made every effort to guide their members to resources designed to help them navigate stimulus programs like the Payroll Protection Program, our organizations see the need to implement equitable and transparent programs that help disadvantaged communities weather this unprecedented storm,” states a letter from BW2020, primarily addressed to House Speaker Nancy Pelosi (D-Calif.), Senate Majority Leader Mitch McConnell (R-Ky.), House Minority Leader Kevin McCarthy (R-Calif.) and Senate Minority Leader Charles Schumer (D-N.Y.).

The letter states that the previous CARES Act (PPP), was worthy of applause for its “valiant efforts by members of Congress.” But many “businesses in the minority community were not able to receive” equitable financial relief.

Among a string of benefits that could significantly impact Black people, the Democratic-led $3 trillion proposal would provide $900 billion in federal funding to states and cities; another round of stimulus checks and possible expansion of unemployment claims.

But the bill passed the House along close partisan lines 208-199; so political observers doubt that it will make it through the Republican-led Senate any time soon if ever. Senate leaders say it’s too much money for the deficit. They were expected to take it up after Memorial Day this week.

Senate Majority Leader Mitch McConnell (R-Ky.), has called the House bill “an unserious product” and President Trump, who would have to sign it, called it “dead on arrival”. But Senate leadership has indicated that they do see the need for more relief and stimulus; therefore, members could significantly alter parts of the bill. If the Senate passes a marked-up version of the bill, there would still be time to negotiate needed improvements through a Conference Committee, which is made up of members of the House and Senate.

Black Wealth 2020 comprises major Black organizations with thousands of members in banking, business and home ownership. “We are unified in a common goal to shape a black economic policy agenda around three pillars: promoting black owned businesses, black homeownership and black owned banks,” the letter states.

The BW2020 letter makes a plea for bi-partisanship despite the drawback from Senate Republicans.

“The bill should have bi-partisan support because ours is an economy that depends heavily on consumer suspending. When Black and brown people in America have less to spend, the adverse ripple effects will eventually cost everybody in the country,” said Michael Grant, former president of the National Bankers Association, a Black Wealth 2020 founder, in an interview.

Ron Busby, president/CEO of the U. S. Black Chamber Inc., says Republicans must beware of the long-term effect of COVID-19 that could affect the economic principles that they espouse as being important to their agenda.

“We’re about to lose 35-40 percent of Black-owned businesses in America due to the pandemic. That’s a projected outcome. So, if this administration is truly concerned – and our president has been touting the unemployment numbers for Black people – then he must address the salvation of Black businesses.”

The letter was copied strategically to Treasury Secretary Steven Mnuchin and key committee leaders in the House and the Senate; including the House Ways and Means and Banking Committees and the Senate Appropriations and Finance Committees.

In a nutshell, among other new policies, the letter suggests the following:

- A policy that would require credit bureaus not to report late payments on all credit reports for three months and a required erasure of late payments from credit reports for the same period that have already been filed.

- A fund that would be released to banks from which individuals could redeem up to $600 to cover one month’s payment of a bill with proof of the bill they are attempting to pay.

- The establishment of a $25 million Home Ownership Assistance and Outreach Program through HUD.

- Add $100 million to the Technical Assistance and Outreach Grants through the Minority Business Development Agency.

- Establish Micro Enterprise Grants through the Economic Development Administration for the many small businesses who have less than 20 employees or are even sole proprietors and do not have access to as many resources as their larger counterparts.

- Add $1 billion to the Community Development Block Grant program earmarking those funds to help the most distressed neighborhoods.

- Expand HUD Section 184 to include African-Americans (provides 2 percent interest rate residential mortgages for FHA).

- Introduce and support the American Dream Down Payment Act. This bill establishes a down payment assistance program similar to the 529 college savings program.

The letter was signed by Grant, Busby, and other principals of the following organizational members of Black Wealth 2020: The National Association for Equal Opportunity in Higher Education (NAFEO); National Association of Black-owned Broadcasters; HomeFree-USA; National Association of Real Estate Brokers (NAREB); National Association of Securities Professionals; and the Collective Empowerment Group Professionals.

According to the Joint Center for Political and Economic Studies, the following are among the benefits of the proposed “Heroes Act” that significantly impact Black people:

- Economic Support for Individuals: Attempts to provide economic relief to families by extending the weekly $600 federal pandemic unemployment compensation supplement through January 2021.

- More stimulus: A second round of direct stimulus payments of up to $1,200 per person and $6,000 per household to an expanded set of families. The bill also increases the maximum Supplemental Food Assistance Program (“SNAP” or “food stamp”) benefit by 15 percent, waives work requirements for SNAP benefits, and provides additional funding for child nutrition programs and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

- Assistance to impacted renters and homeowners: $100 billion to support low-income renters avoid eviction, $75 billion to provide homeowners with direct assistance for mortgage payments and other housing costs, and $11.5 billion for housing and health services for people experiencing homelessness.

- Subsidies for testing and health Care: $75 billion for testing and contact tracing, and $100 billion to hospitals and health care providers for expenses resulting from the coronavirus.

- Black Businesses and Access to Capital: Directs additional resources to community development financial institutions (CDFIs) and minority depository institutions (MDIs).

- Demographic Data: Requires demographic reporting by the SBA on PPP loans, and by HHS on COVID-19 cases in nursing homes.

- Digital Divide: $4 billion to expand high speed internet access to those who cannot afford it, and another $1.5 billion to expand internet access to students and library patrons.

- HBCUs: $1.7 billion for HBCUs and Minority Serving Institutions hit disparately by hardships due to the Pandemic, including $20 million for Howard University, and authorizes and prioritizes grants to HBCU medical schools.

- Environmental Justice: $50 million to the EPA for environmental justice grants to study or address disproportionate impacts of COVID-19 in communities.

“The Heroes Act is already an essential bill with significant offerings that will at least move America closer to the sorely needed relief during this moment of untold suffering around the nation and world,” said Grant. “We are hoping that the powers that be will set aside partisanship to allow the necessary aide to flow amidst this great disaster.”

CREDITS: The Charleston Chronicle