Black real estate group focuses on community investment

By R.A Schuetz

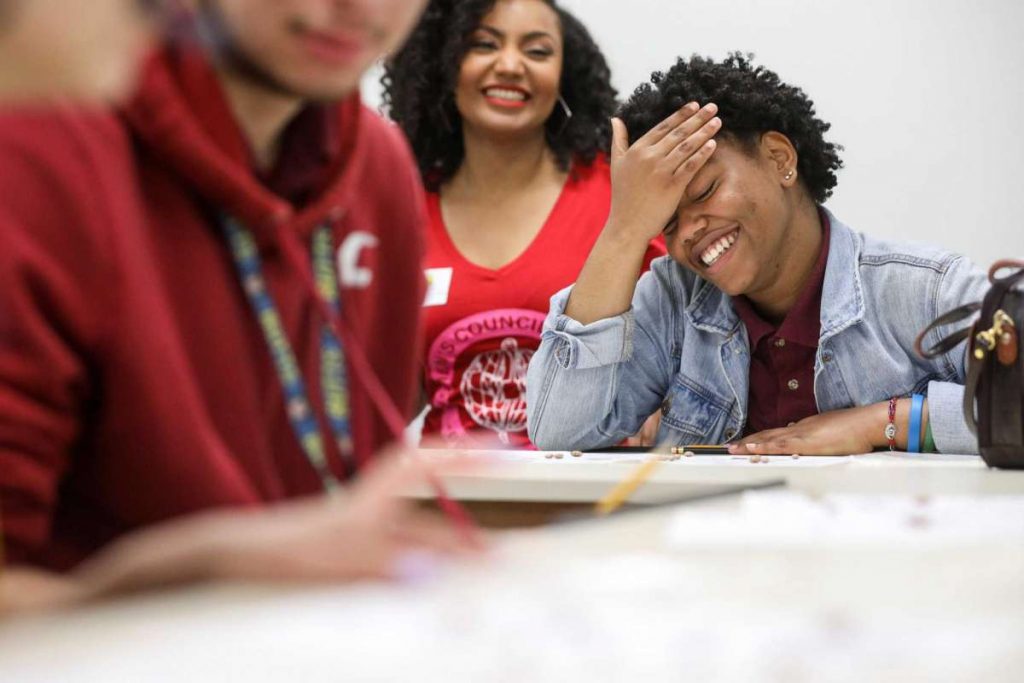

Tuliza Noela, a junior at Wisdom High School in Mid-West Houston, deliberated Thursday morning over her budget. She decided she would live with relatives instead of renting her own place, since the resulting savings could be applied toward a new car. Noela framed the decision as a matter of financial security. With used cars, she explained, “there might be some issues.”

The exercise was part of a financial literacy class during Realtist Week, a series of outreach events hosted by the Houston Black Real Estate Association and its sister organizations across the nation. Founded during a time when black real estate agents were not allowed to become Realtors (instead, HBREA members are called Realtists) the association has always had a twofold mission. In addition to helping people buy and sell homes, it supports programming and raises awareness to overcome a legacy of discriminatory housing practices.

As part of Realtist Week, HBREA members visited a church and met with politicians. On Saturday from 10 a.m. to 3 p.m., the organization will host its marquee event, a wealth-building fair at Good Hope Missionary Baptist Church near Texas Southern University that will feature banks, city officials and nonprofits. HBREA leaders expect 4,000 to attend.

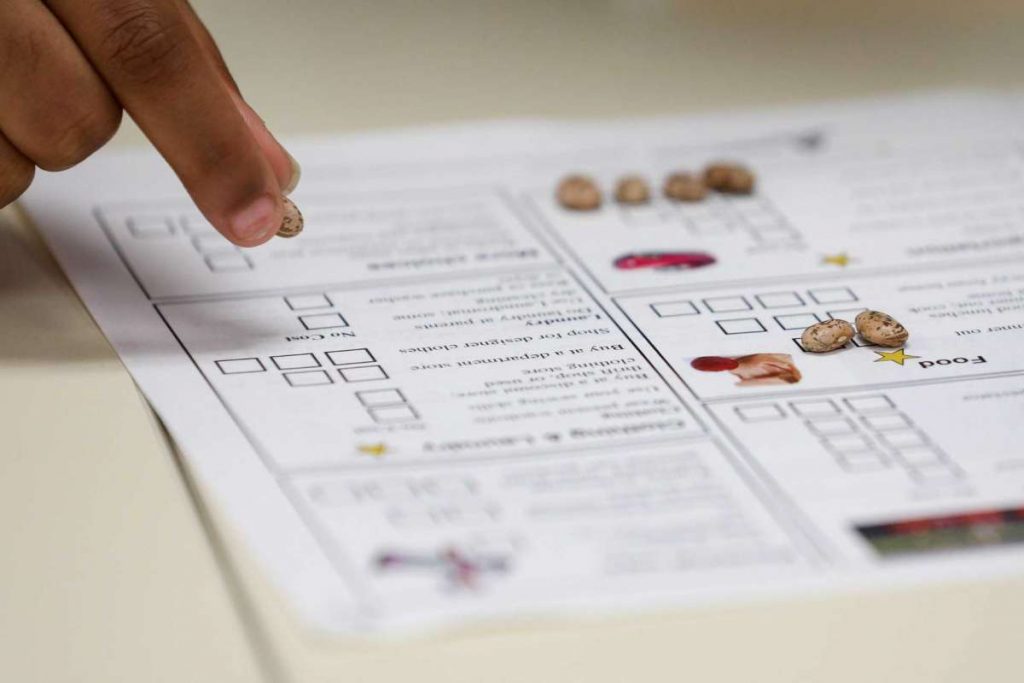

Noela was part of a class led by LaTisha Grant, who coached students as they planned out their fictional budgets as part of one of HBREA’s financial literacy workshops that teach students and adults how to build the wealth that could one day be invested in a home.

In her class, the students used beans to represent their salaries. When a student cried out that he needed one more bean to make his budget work, Grant, who runs the Women’s Council, an education-focused auxiliary of HBREA, raised her eyebrows and flashed a grin.

“You could ask your employer for an advance,” she said, pretending to mull over his options. “But they’re not going to give it to you. You could ask a friend for a bean, but they all have the same number of beans as you. You’re going to have to re-allocate one of your beans.”

Raising Awareness

HBREA was founded in 1949 by a group of 11 real estate brokers; since then, its membership has grown to more than 350. Realtist Week has been celebrated by the group since its founding and often draws new members. During Realtist Week last year, membership grew by 20 percent.

LaDonna Parker, president of HBREA, said the goal of Realtist Week was to raise awareness about the organization’s resources. “We work with everyone, from the underrepresented to the accomplished,” she said. “We want people to know: Whether they need credit repair or investment advice, we are a resource.”

In addition to budgeting lessons, HBREA and the Women’s Council offer classes to students and adults about understanding and improving credit scores, buying a home, down payment assistance programs and entrepreneurship.

The classes are funded in part by the Community Reinvestment Act, a federal law designed to encourage commercial banks to meet the needs of borrowers in all segments of their communities. Banks are evaluated on whether they have a record of serving people of different incomes who live in different neighborhoods, including low-income neighborhoods, requirements enacted in 1977 to prevent redlining.

Challenges Loom

As the students revised their budgets — Grant announced an economic downturn that had reduced their salaries to 13 beans from 20 — HBREA was grappling with a potential funding change of its own. The Trump administration is considering making changes to the Community Reinvestment Act to lessen the burden on financial institutions.

According to National Community Reinvestment Coalition, a nonprofit that tracks lender community investment, the act has resulted in $980 billion investment since 1996. The bulk of investment is made in the form of loans in low- and moderate-income neighborhoods.

Other investments qualify as well, including becoming an equity partner in an affordable housing project or donations to groups like HBREA that engage in financial literacy training. Often, when banks are preparing for a merger and realize their compliance Community Reinvestment Act will be scrutinized, they will step up their philanthropic initiatives.

On April 3, the Treasury released a memorandum recommending changes to the way Community Reinvestment Act compliance is evaluated and re-examining how it will define whether banks meet the needs of borrowers in all segments of the communities. The changes could have wide-ranging consequences for how banks make loans, investments and donations in low-income neighborhoods.

Aiming for Self-Sufficiency

Parker was adamant that there was no room to reduce the requirement for banks to lend to all segments of the community. “Inequality is unconstitutional,” she said firmly.

But if those changes result in reduced funding for educational initiatives, Parker said HBREA is ready. The organization is in the early stages of what could become a new business model. Parker said the HBREA is exploring the possibility of becoming a property owner itself, taking advantage of the new Opportunity Zone tax incentive program to build a headquarters that would also generate revenue by leasing space to minority-owned businesses and providing a senior or assisted living center.

The revenue stream from such a project could ensure HBREA’s mission would be funded for years to come. “Self-sufficiency is always the goal,” she said.

That goal also echoed throughout the classroom at the end of the financial literacy class, with multiple people saying they would have saved more and purchased health insurance if they could have started over.

“I’m going to invest in my retirement,” said Eyanni Waterman, also a junior, as the workshop drew to a close and students prepared to return to their day-to-day lives.

CREDITS:

The post Black real estate group focuses on community investment appeared first on National Association of Real Estate Brokers.