African American homeownership rates on the decline in southeast Michigan as Fair Housing Month looms

By: Gina Joseph

By Gina Joseph gjoseph@medianewsgroup.com and @ginaljoseph on Twitter

Willie Davis is 33-years-old.

He’s African American.

And Davis, a Troy real estate agent, is looking to purchase a home in Clinton Township.

In looking at homeownership rates among black households across southeast Michigan, he’s an exception, as are some of his clients, including Benjamin and Seane Pettis, who recently purchased a three-bedroom ranch in Fraser.

Homeownership rates for African Americans are below 50 percent in Macomb, Oakland and Wayne counties, and the city of Detroit.

“We knew it was time to find a house after we had our son but we never imagined it was possible,” said Seane.

However, she knew Davis while growing up in Mount Clemens and she and Benjamin enlisted his help as a realtor for RE/MAX Eclipse in Troy after seeing his business ad on Facebook.

“We didn’t know how things would go at the bank or with the mortgage companies but he directed us to the right resources — so we could imagine being homeowners,” she said.

“Now that we are, it feels great,” Seane added, while tending to her 2-year-old son. “The school district is awesome and our neighbors are amazing.”

Seane said she and Benjamin were surprised that they were able to find a home and encourages other African Americans, or anyone else considering homeownership to go for it.

“It takes some work. You have to have your finances and credit in order. It doesn’t have to be the highest credit score, but it doesn’t hurt,” she said. “And believe that things can happen. Have faith and play on it.”

Homeownership

After fair housing legislation was passed in 1968, the percentage of African American homeownership increased for 30 years but peaked at about 50 percent nationally in 2004, according to the U.S. Census.

Kurt Metzger, founder of Data Driven Detroit and mayor of Pleasant Ridge, said that, locally, gains in African American homeownership have largely been erased in the last dozen years.

Metzger said the homeownership rate for black households nationally ended 2016 at 41.7 percent, a 50-year low.

“Black homeownership hasn’t been this low since the time when housing discrimination was legal,” Metzger said.

Metzger said a number of factors have contributed to declining homeownership rates among African Americans.

The Great Recession that began in late 2007 negatively affected homeownership for all races and drove up the foreclosure numbers, but particularly for African Americans.

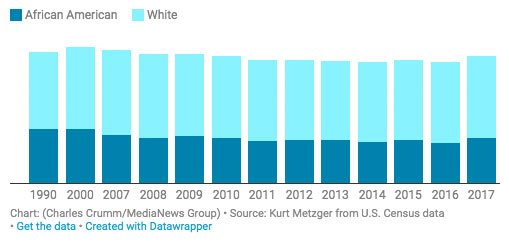

Percentage of African American and White home ownership in Oakland County by year:

African American homeownership rates were:

- 49 percent statewide in 2007 but 41.8 percent by 2017,

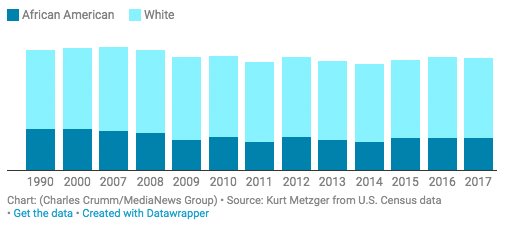

- 38.6 percent in Macomb County in 2007 and 31.4 percent by 2017,

- 46.8 percent in Oakland County in 2007 and 43.4 percent by 2017,

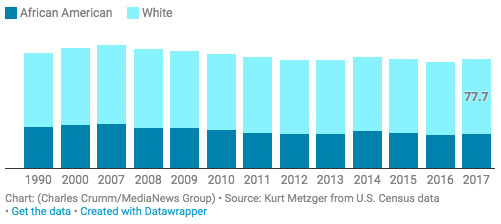

- 46.1 percent in Wayne County, excluding Detroit, in 2007 and 45.6 percent in 2017, and,

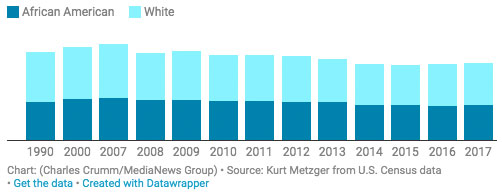

- 54.3 percent in Detroit in 2007 and 35.3 percent in 2017.

By comparison, homeownership among whites has remained much higher, though it also suffered after the Great Recession:

- 80.1 percent statewide in 2007 down to 77.8 percent in 2017,

- 83.4 percent in Macomb County in 2007 down to 78.9 percent in 2017,

- 82.3 percent in Oakland County in 2007 down to 78.8 percent in 2017,

- 81.7 percent in Wayne County, excluding Detroit, in 2007 down to 77.7 percent in 2017, and,

- 70.7 percent in Detroit in 2007 down to 54.1 percent in 2017.

Metzger said one reason for the drop in homeownership rates, particularly among African Americans, was the use of exotic loan products and predatory lending that caused foreclosures when the housing market crashed.

But Metzger said the reasons for the decline in African American homeownership are many and complicated.

“Various studies have shown that African Americans as a group, compared with whites, have lower credit scores, lower incomes and lower education levels,” Metzger said. “The lower homeownership rates contribute to these social problems because blacks are denied a primary wealth-building tool.”

The falling homeownership rate has deep social implications for future African American communities and neighborhoods.

“Homeownership is the number one way for African Americans to build wealth,” said Ron Cooper, president of the National Association of Real Estate Brokers (NAREB). “There are so many other things tied to it.”

Tax foreclosures remain an issue in Detroit and other majority and plurality African American jurisdictions in the state, according to a report by Carl Hedman, research analyst in the Metropolitan Housing and Communities Policy Center (MHCPC) at the Urban Institute and Rolf Pendall, a nonresident fellow in MHCPC for the Urban Institute and professor of urban and regional planning at the University of Illinois, titled, ‘Rebuilding and Sustaining Homeownership for African Americans.’

In their report for the nonprofit Urban Institute, Hedman and Pendall recommended several policy actions pertaining to foreclosures to help to sustain and rebuild homeownership among African Americans.

These included communicating more effectively with them, permanently reducing penalty interest rates for overdue taxes, allowing for payment plans, increasing intergovernmental revenue transfers to segregated, low-income jurisdictions, and doing everything possible to support residents’ incomes and stabilize their livings costs.

Also covered in the Hedman/Pendall report were land installment contracts or contracts for deeds.

Those are arrangements in which a seller finances the sale of a residence directly to a buyer, often through monthly installment payments and are more precarious for buyers than traditional mortgages. In many cases, the contracts are not legally registered and if a buyer misses a payment the seller can cancel the contract and take the property.

“Although the arrangements are not new, following the financial crisis they have been on the rise in African American communities in Michigan and across the country,” according to Hedman and Pendall.

To help reduce losses from land contracts Hedman and Pendall believe that the contracts should be registered and that legal standards for the agreements should be introduced. Other recommendations included clearing all liens and debts on the property before sale, requiring third-party appraisals and independent inspections and identifying and taking appropriate action against bad actors.”

Fair Housing Month

April is Fair Housing Month and observes the Civil Rights Act of 1968, also known as the Fair Housing Act.

The act prohibits discrimination in the sale, rental and financing of housing based on color, race, national origin, religion, sex, disability and family status.

More specifically, it outlaws:

- Refusal to sell or rent a dwelling to any person because of his/her race, color, religion or national origin.

- Discrimination against a person in the terms, conditions or privilege of the sale or rental of a dwelling.

- Advertising the sale or rental of a dwelling indicating preference of discrimination based on race, color, religion or national origin.

- Coercing, threatening, intimidating, or interfering with a person’s enjoyment or exercise of housing rights based on discriminatory reasons or retaliating against a person or organization that aids or encourages the exercise or enjoyment of fair housing rights.

Percentage of African American and White home ownership in Macomb County by year:

Percentage of African American and White home ownership in Detroit by year:

Percentage of African American and White home ownership in Wayne County, excluding Detroit, by year:

Credits: Gina Joseph | The Oakland Press